Capital Structure

What Is Capital Structure?

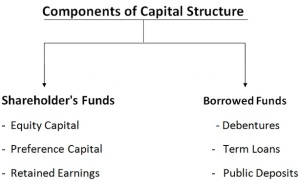

When you are asking about what the capital structure is and what it relates to what you will find is that it is regarding the debt and equity within a business environment. It is the amount of debt and equity that mixes together to give the amount of return on investment and shareholder’s pocketbooks while at the same time keeping the cost at minimum level.

When looking at the financial management of a company you will find that to be effective a company should have effective leverage. In this article regarding financial management you will find some specific information regarding optimal capital structure and what the effects of debt are on the capital structure you have attained.

Types Of Leverage:

When working on capital structure you will find that there are many different types of leverage.

The first type that needs to mention is financial leverage. This is the ratio of the EBIT/EBT earning before the interest and the taxes compared to the earnings. The financial leverage is created when the company/business is relying solely on the funds they have borrowed for the financial operations of the company.

Operating Leverage: Any change in the amount of operating income can have impact on different financial aspects of a company. A large percentage change when talking about the firm’s net income can cause changes in the earnings per share while a small change can result in major changes in the reduction of net income. It is best to have a long term financing plan in place that will also involve the perfect solution of debt and equity.

Operating Structure

The operating structure of the business can often be changed accordingly if needed. This will include the fixed operating costs. Examples of these costs are any administrative overhead, contractual salaries of your employees, mortgage/lease payments or any other expense that you may be paying every month that does not change from month to month. As a business owner, you will see that you operating leverage come into play when there is a change in the net sales that results in a change in the operating income earnings.

Combined Leverage

The combined leverage is defined as the combination of the effects of a business risk combined with the financial risk of the business. When speaking of leverage relationships there is a direct correlation between the degrees of operating leverage, financial leverage and combined leverage. There are many different calculations that can be created within these different operating margins.