Project Analysis – Capital Budgeting Techniques

Solved example of Payback Period and ARR

Steve has been appointed as finance director of a company. His only aim is to gain some experience before moving to a larger company. His intention is to work here for three years and when he would leave the company; its share price must be standing high. For that reason he is concerned only about the reported profits of the firm should be as high as possible in his last year with the company.

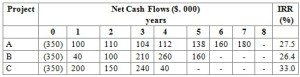

The company has $350,000 to invest and directors are considering three different projects A, B and C(Mutually Exclusive Projects i.e. only one project can be undertaken), each required immediate purchase of machinery coasting $350,000. Useful life of the machinery is equal to that of the project with no scrap value. Steve is biased towards project C because it is expected to generate highest accounting profit in the year 3. However, he doesn’t want to disclose his real reason for recommending project C. In his report he recommends project C because it shows the highest IRR.

The CEO of the company used to appraise projects on the basis of Payback period and accounting rate of return. He was not comfortable with the recommendation of Steve as he used internal rate of return as a method for selecting project. Accordingly, he asked independent report on the selection of the project. The company use straight-line depreciation method to write off the cost of machinery and cost of capital of the company is 20%.

Given below is the summary of all three projects:

Solution:

First, we will calculate the payback period for each project

Payback period of project A:

The initial cost of the project is $350,000. After the first three years, the cash flows total $314,000. After the fourth year, the total cash flow is $426,000, so the project pays back sometimes between the end of year 3 and the end of year 4. Because the accumulated cash flows for the first three years are $314,000, we need to recover $36,000 in the fourth year. The fourth year cash flow is $112,000 so we will have to wait $36000/112000= 0.3 year to do this.

The payback period of project A is thus 3.3 years or about three years and three months 18 days.

Payback period of project B:

After the first three years, the cash flows total $350. Thus the payback period of Project B is 3 Years.

Payback period of project C:

After the first two years, the cash flows total $350. Thus the payback period of Project C is 2 Years.

Now we will calculate the accounting rate of return for each project.

Accounting Rate of Return formula:

ARR=Average Annual Net Income/Initial Investment outlay

ARR of Project A:

Net cash flows generated by the project= $904,000

the initial cost of the project = $350,000

Total profit = $904,000 – $350,000

Total profit = $554,000

Annual Profit = $554,000/7

Annual Profit = $79,143

ARR = 79,143/350,000 X 100

ARR = 22.61%

ARR of Project B:

Net cash flows generated by the project= $770,000

the initial cost of the project = $350,000

Total profit = $770,000 – $350,000

Total profit = $420,000

Annual Profit = $420,000/5

Annual Profit = $84,000

ARR = 84,000/350,000 X 100

ARR = 24%

ARR of Project C:

Net cash flows generated by the project= $630,000

the initial cost of the project = $ 350,000

Total profit = $630,000 – $ 350,000

Total profit = $280,000

Annual Profit = $280,000/4

Annual Profit = $70,000

ARR = 70,000/350,000 X 100

ARR = 20%

Decision:

Company should not choose project C as recommended by Steve as its ARR is the lowest among all three projects. As project A, B & C are mutually exclusive projects, therefore; company should select project with the highest ARR which is Project B.