Weighted Average Cost of Capital

Weighted average cost of capital

Weighted average cost of capital (WACC) means to the average amount of minimum rate of return after paying the tax that a company must bring home for its all security holders including debt holders, common stockholders, and preferred stock holders.

How to Calculate WACC?

The calculation of the weighted average cost of capital is based on the formula where it is found out the cost of every component of the capital structure of the company and then multiplying it with the appropriate proportion of those components with the total capital and at the end, sums up the entire proportionate cost of components. It has been proved that WACC is quite helpful tools since it can predict whether a particular project can increase the wealth of the shareholders or it can just compensate the cost.

WACC Formula

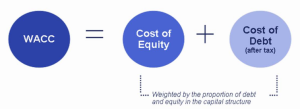

When a company has two prime sources of finance like equity and debt, the WACC of the company is calculated by following this formula –

WACC = r(E) × w(E) + r(D) × (1 – t) × w(D)

Weights

w(E) stands for the cost of equity formula of a company and it is calculated by dividing the market value of its equity by the total of market values of debt and equity.

w(D) stands for cost of debt formula of a company in its capital structure and it is determined by dividing the market value of its debt by the total of market values of debt and equity.

Ideally, weighted average cost of capital formula is estimated by using the target capital structure, and this capital structure is intended to be maintained by the company’s management for a long duration. However, for the practical usage, the market values are used and wherever the market values are not applicable or available, book values are used by the company’s management in order to find out the weight.