The Cash Conversion Cycle is Vital to Business Success

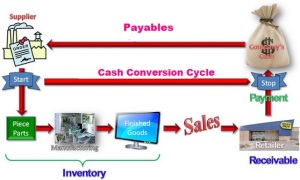

The Cash Conversion Cycle tells a decision maker how long his business may be without the cash that has been used to fund a purchase. It is all about liquidity and that is essential for every business because ‘cash is king.’When the annual budget and forecast is prepared it includes a cash flow which includes assumptions about when bills are due to be paid out and when the predicted sales revenue will actually get into the bank.

The Cash Conversion Cycle tells a decision maker how long his business may be without the cash that has been used to fund a purchase. It is all about liquidity and that is essential for every business because ‘cash is king.’When the annual budget and forecast is prepared it includes a cash flow which includes assumptions about when bills are due to be paid out and when the predicted sales revenue will actually get into the bank.

In the olden days, trade was fairly simple. The market trader bought his goods, sold them then bought some more. He lived from what he had in his pocket and that varied by how long it took him to sell everything and buy again. Today’s businesses cannot work like that. Every business needs to have a positive cash flow even if it has large assets. Every decision maker needs to know his stock levels and replenishes stock as required. However, if another stock is tying up the money he has to find a solution.

Retailers

Retailers have to hold stock in order to attract custom. The secret of success is not to hold too much stock relative to sales. Suppliers may permit credit accounts but invoices are generally due after 30 days. A retailer cannot permit himself to have too much stock from that invoice left when the bill becomes due. Companies that buy on credit but sell on credit need to find the right balance and be able to respond to problems when that balance is damaged. There are companies that have an even more difficult task.

Employment Agencies

Employment Agencies are in the business of hiring out workers for anything from a couple of weeks temporary placement with existing clients to longer-term contracts that can be several months. The Agencies retain the responsibility for paying those people and regain their money as well as the profit from the deal. It sounds good before closer analysis.

The staff doesn’t give credit so weekly staff will expect to pay every Friday; monthly at the end of the relevant month. A client will usually want to pay a monthly invoice and want 30 days’ credit. Do you see the problem? You pay a weekly worker four times before the invoice is even raised and another four times before it is paid and that is if the payment comes on time. Likewise, with monthly salaries, you are always a month out of pocket.

Start Right

This is a situation that has to be factored into the business from the first day it opens its doors for business or it will surely fail. It is an extreme example but it illustrates the importance of having a proper strategy, a good business plan and accurate information about how the business is performing.

Credit control is a vital function for the business. Sales are of little value until the customer has paid. Normal trading terms can sometimes be ignored. The recession highlighted the problem with some businesses simply unable to meet their commitments. Accounts receivable and accounts payable if anything needs to be positive for a business to run successfully. It is not an exact science hence the need for good controls, management, and decision making. Few businesses could succeed without proper management information to form the basis for decisions.

Vital

It is why the Cash Conversion Cycle information is so important. It is data that could persuade a company to change direction to concentrate on profitable products and customers rather than for example volume customers who simply want to take as long a credit period as possible. It certainly informs a ‘boss’ if the credit control department needs to take a more aggressive stance with customers.