Correlation Matrix

What is Correlation Matrix?

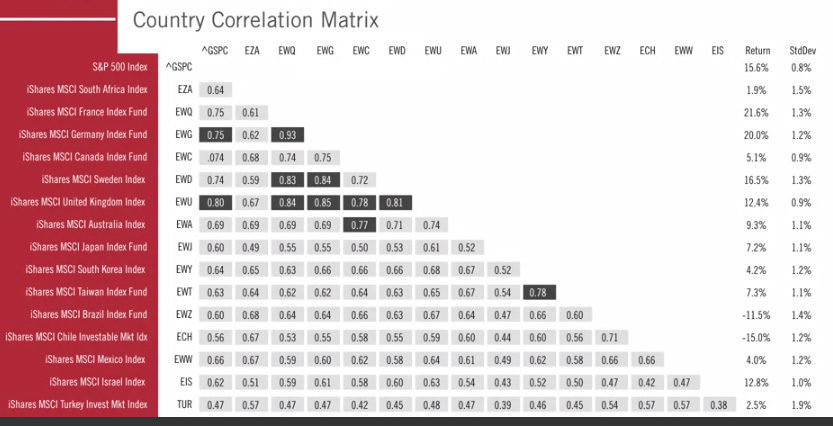

A correlation matrix is simply a collection of correlations and some of those numbers may not be large enough for you to see all of them, and some of them are very dark. The ones that are very dark are numbers, which are higher than 0.75 and that does not really matter for us either. Look at the ones that you can see pretty clearly.

Those that they have kind of a mustard color. All of them are positive. If you actually look at different equity markets around the world, the correlation between all those markets tends to be positive. It could be a little higher; it could be a little lower, in the case of the reddish, sales there that correlation is very high. In the case of the yellowish, sales that correlation is somewhat lower but in different degrees, all the markets, all the equity markets tend to positively correlated. I will typically think of correlations, they could theoretically be positive or negative but if we focus on equities i.e. individual securities within a market or markets within the world market, all those correlations they tend to be positive. They can be stronger or weaker, but in terms of the sign in all cases, they are positive. The second thing that is very important about this correlations and goes back to my initial comment and that is, again, I know that people they tend not to like this issue that has to do with correlations.

Well, if you are working portfolio management, you cannot ignore correlations. They are the bread and butter of forming portfolios. The one thing that you always want to look at is whether the assets that you may think of, of bringing into your portfolio, whether they are highly correlated or lowly correlated, to the assets that we already have in the portfolio.

Correlation in practice, they are absolutely essential. Very practical lessons that you can get there. Why the math of correlation matters. An article in the Financial Times. The rise and rise of correlation. Another article in the Financial Times. Risk asset correlation strikes again. Another article in The Wall Street Journal. Advisers see REIT correlations subsiding. Another article in the Financial Times. Correlation breakdown spells end for broad stock market gains. What I am trying to show you with that is that correlation are incredibly important from a practical standpoint. From the point of view of building portfolios. From the point of view, of assessing the risk of the portfolios, we cannot ignore correlations.