Theories of Portfolio Management

Risk Aversion Theory

The theory that counts for being risk aversion highlights the fact that the investors always opt for such kinds of investments which are associated with the lowest level of risk. Every individual who plans to invest in something requires the maximum possible return but with the low level of risk. In this regard if you keep two investments in front of a sensible investor with the same return but different level of risk then obviously the investment with low risk will be opted for.

Markowitz Portfolio Theory

Markowitz Portfolio theory is based on the development made by Harry Markowitz which is based on the behavior of the investors in terms of risk and return. The behavior over which the investment is usually depending upon comprises of the following factors:

- When the level of return is same between two investment opportunities, an investor will consider the opportunity with the lower risk level.

- The measurement of level of risk by the end of investors is carried out in terms of the standard deviation and variance techniques.

- The identification and measurement of the return over a certain period of time from a specific investment may be easily quantified.

- Utility maximization is the optimum need of every investor.

- The decision being made by the investors is usually on the risk and the return and so as the curve of investment’s utility.

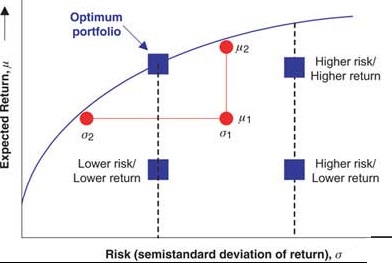

Considering Efficient Frontier

Another factor which was highlighted by Markowitz was the behavior of the entire portfolio of investment. He stated that only considering the behavior of a single investment is not the right thing however, the entire portfolio must be assessed on the basis of risk as well as return as the impact is related to one another.

An efficient portfolio of investment is the one which offers the investors a rate of return higher however the risk level remains either a lower one or the same when considered in relation to the other investments.

Efficient Frontier is a graph which ends up representing the portfolio of investment an individual holds in context of risk and return however; at times the efficient portfolio may not suit every investor as the major inclination lies over investment policy. The entire policy statement is based on the consideration of risk and returns and is regarded as an essential point of consideration as compared to anything else, whereas the presence of the Efficient Frontier also lies after it.