Portfolio Risk and Reward

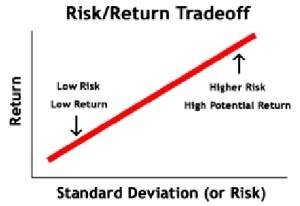

Investment is always associated with two most important things namely, risks and returns and measuring both of these is always a crucial part of every investment. When it comes to the measurement of the risks and returns you may come across a number of measurement techniques of which Standard Deviation takes the lead. Standard deviation is the measure of the dispersion observed between the actual and the expected returns from an investment. When we talk about standard deviation, variance becomes equally important being the square root of standard deviation.

Investment is always associated with two most important things namely, risks and returns and measuring both of these is always a crucial part of every investment. When it comes to the measurement of the risks and returns you may come across a number of measurement techniques of which Standard Deviation takes the lead. Standard deviation is the measure of the dispersion observed between the actual and the expected returns from an investment. When we talk about standard deviation, variance becomes equally important being the square root of standard deviation.

When you need to measure the basic risk associated with the investment making the use of standard deviation allows you a perfect form of measurement. When two investors with a same expected return are compared with the results of standard deviation, the one with the lower outcome is said to be at low risk.

However, apart from standard deviation a few other measurement techniques are:

Alpha – It takes into account the measure of the stock price of a specific security and its volatility as well depending upon the characteristics incorporated in that security.

Sharpe Ration – It measures the volatility of the portfolio of investment or the stock invested taking into account the standard deviation. It provides a measurement of the incremental risk associated with an investment and also the incremental rewards expected against the taken risk.

Beta – It works by taking into account movements in the market being general and not specific. The higher the Beta, the higher is the risk and the return as well. The fixed value of Beta being allocated to the market as a whole is 1, and the measurement that increases the figure of 1 will generate higher returns and offers higher risk too.

Steps of Asset Allocation

Every portfolio of investment comprises of several different investments of which a few are growth oriented and a few are investment oriented, maintaining a balance among both the kinds of investment is called as Asset Allocation. The steps associated with the asset allocation are as follows:

- Which class of assets has to be incorporated is a matter of concern to be selected at first, for e.g. bonds, precious metals, money markets etc.

- Each class of assets being selected for a portfolio then needs to have an assigned percentage for the target.

- A range acceptable within the criteria of the target is also required.

- Each class of assets then needs a diversification.

Tolerance of Risk

Each individual has a different level of risk tolerance, it is not necessary that every individual may tolerate the risk associated with each class of asset. People with a different mindset and different backgrounds have different level of tolerance and it also changes with the passage of time. What one can tolerate today might not be tolerable after a few years and all this needs to be taken into account in the context of investment risks as well.

Time Period

The nature of the investor and the tolerance level is also associated with the time horizon and the allocation mix of a portfolio as well. Someone who is aggressive with the investments and the risks might have a different mindset for the time horizon when compared to someone who is reluctant to take risks.