Internal Rate Of Return And Mutually Exclusive Projects……. What’s the Concern?

While considering the mutually exclusive projects, IRR technique can be misleading. Investment projects are said to be mutually exclusive if only one project could be accepted and others would have to be rejected.

NPV and IRR methods for project evaluation leads to conflicting results under following conditions:

- The pattern of cash inflows plays an important role in project evaluation while using IRR method. i.e. The cash flows of one project may increase over time, while those of others may decrease and vice versa. The major drawback with the IRR method is that for mutually exclusive projects, it can give contradictory investment decision when compared with NPV.

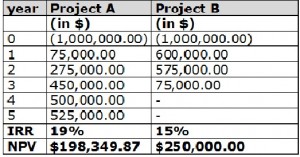

Consider the following example.

In the above example A and B are mutually exclusive projects. Both projects require an initial outlay of $ 1,000,000.00 but the pattern of cash inflows is different. Cash inflows for Project A are increasing over the period of time while for Project B these are declining. IRR decision rule leads to select Project A as Project A IRR>Project B IRR. But decision on the basis of NPV evaluation implies that project B is more viable. Thus on the basis of mere IRR the company may select less profitable project.

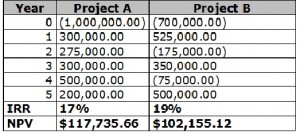

The cash outflow of the projects may differ. i.e. a project may need capital outlay not only at the time of investment but after regular intervals during its expected life. Consider the following example:

Project A requires an initial outlay at the beginning of the project while Project B needs cash outflow in year 2 and year 4 also. Decision based on IRR method leads to select project B but NPV of project B is less than of Project A. again under such circumstances IRR method plays a deceive role.

Summarizing the above discussion the timings and pattern of cash flows can produce conflicting results in the NPV and IRR methods of project evaluation.

Nice post. I rarely found anything more informative on such topics like this. Giving various angles to look into your decision making process instead to dump your money in fire while evaluating multiple projects. Thanks once again and Keep it up.

It is a nice post. Yes, but i do not see the method to be used if irr and npv are less suitable. What if the projects are mutually exclusive and are of different lives with different cash flows.

Thanks.