IRR Decision Rule

IRR is one among a number of capital budgeting techniques which is most commonly used by the investors for evaluating their investment decisions.

IRR is one among a number of capital budgeting techniques which is most commonly used by the investors for evaluating their investment decisions.

What is IRR?

IRR is the discount rate on which NPV of a project becomes Zero OR we can define IRR as the discount rate at which Present Value of cash inflows becomes equal to the Present Value of cash outflows.

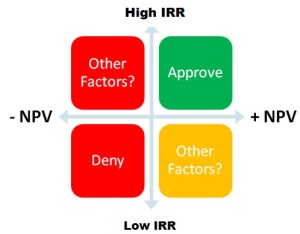

IRR decision rule states that if

Internal rate of return of a project > the required rate of return (or cost of capital) of the project

Then the best course of action for the investor is to proceed with it.

On the other hand, if

Internal rate of return of a project < the required rate of return (or cost of capital) of the project

then investor should not undertake that investment.

However, it is not always necessary that investors choose projects with higher IRR. Sometimes, they may choose to undertake an investment with a lower Internal Rate of Return and may reject an investment with higher Internal Rate of Return just because the former project or investment is expecting to bring some other intangible benefits.

IRR Decision Rule for Mutually Exclusive Projects:

In case of mutually exclusive projects or the projects with equivalent degree of risk but similar returns, the project with higher Internal Rate of Return should be selected.

IRR Decision Rule for Independent Projects:

In case of independent projects, if IRR is greater than the required rate of return then both projects should be accepted and if IRR of both projects is less than the required rate of return then we should reject both projects.